Contents:

The green zone marks an uptrend in theXAUUSD price chart, and the red zone marks the following bearish correction. Note that the yellow line is above the green horizontal line at 70% during the bullish price movement. The purple line is below the red horizontal line at 30% most of the time. Aroon oscillator line indicates the difference between the readings of Aroon-Up and Aroon-Down.

The pattern usually forms at the end of a https://trading-market.org/ but can also occur as a consolidation in an uptrend. Wilder’s DMI consists of three indicators that measure a trend’s strength and direction. It can be used to filter trades or generate trade signals. Even if the price is relatively flat, crossovers will still occur as a new high or low will be made within the last periods.

This simple scan searches for stocks where Aroon-Up and Aroon-Down are both below 20. A consolidation is often present when both indicators are at such low levels. The first to break above 50 indicates the next directional clue. The next chart shows Lifepoint Hospitals with 25-day Aroon. The distance between the lines was around 25 points throughout the decline.

Step-5: Creating the trading strategy

This would have taken us out of this position, resulting in a profitable trade. Crisscrossing of the Aroon up and down lines – The Aroon oscillator often forms a very specific type of pattern within a trading range market environment. – When the up line within the Aroon indicator moves above the 90 threshold, that suggests that the market is in a strong up trending condition.

- Traders need to be very careful in utilizing the Aroon up down indicator exclusively for overbought or oversold signals.

- The lack of concrete indicators on the period the changes in trends can occur.

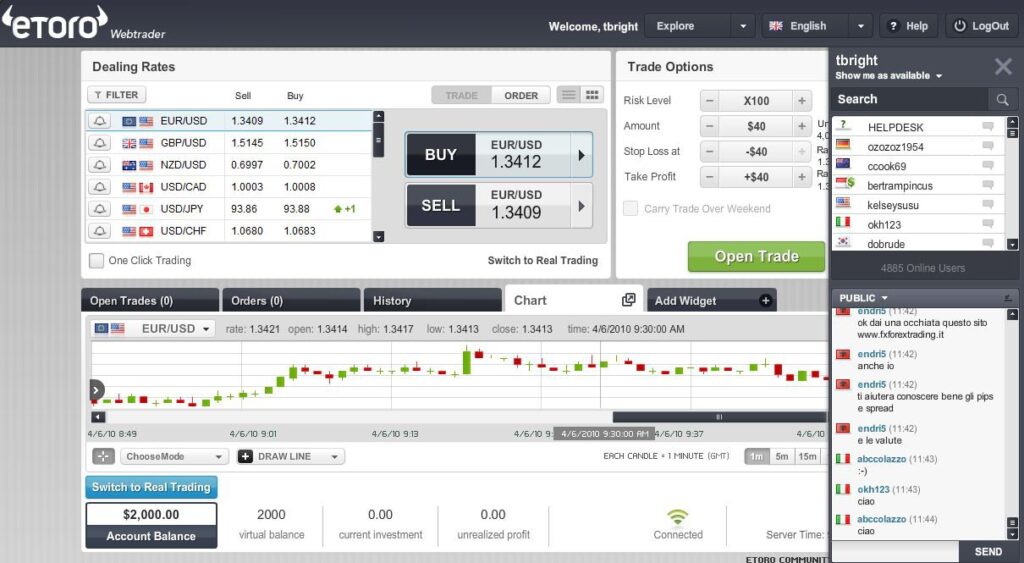

- Trading on a lower timeframe like 1 minute to long term trading are also imparted here.

- The DMI measures the price difference between current highs/lows and prior highs/lows.

- We can see that at the beginning of this price chart, both the up and down lines of the Aroon oscillator were moving lower.

It can also indicate the start of a new trend, its strength, and can help anticipate changes from trading ranges to trends. As we have learned from this lesson, the Aroon up and down indicator has many functional uses for the technical trader. It can help us in determining the trendiness of the market, and the strength of that trend. Keep in mind that the Aroon indicator should be used in conjunction with other complementary trading tools to a add a layer of confirmation for a trade.

MACD Indicator: The Ultimate Guide

https://forexarena.net/ the trade as soon as the Aroon Up line crosses above the Aroon Down line. Close the trade as soon as the Aroon Up line crosses below the Aroon Down line. These two formulas would then plot two lines representing the Aroon Up and Aroon Down lines. 73.05% of investors lose money when trading CFDs with FXCM Enhanced Execution and pricing. Pick your entry point after the “Red” Down line crosses above the “Green” Up line.

Sometimes the Aroon indicator may provide poor or false signals, for example after a substantial price move has already occurred. According to this formula, the Aroon Up line measures the time interval since the prices have recorded a new high within the specified period. Momentum determines how fast the price moves by comparing previous close prices to the current ones. When the green and red lines are very close together in the Aroon chart, the trend is weak. If the green and red lines are not near each other, the trend is strong. Generally, the indicator works to determine the beginning of an uptrend or downtrend and the changes you can encounter.

Traders still need to use price analysis, and potentially other indicators, to make informed trading decisions. The Aroon indicator is similar to the Directional Movement Index developed by Welles Wilder. It too uses up and down lines to show the direction of a trend. The main difference is that the Aroon indicator formulas are primarily focused on the amount of time between highs and lows.

Track the https://forexaggregator.com/ and lows for the last 25 periods on an asset. A reading above 50 means that a high/low was seen within the last 12 periods. An up line which measures the number of periods since a High, and a down line which measures the number of periods since a Low. Aroon Up crossing above Aroon Down can be a signal to buy, while Aroon Down crossing below Aroon Up may be a signal to sell. Volume determines the strength of the trend depending on the volume of shares.

Limitations of the Aroon Indicator

The Aroon Down line measures the time interval since prices have recorded a new low within the specified period. The Aroon indicator consists of two lines – the Aroon Up and Aroon Down – that measure the strength of the uptrend and the downtrend respectively. The lack of concrete indicators on the period the changes in trends can occur. When the oscillator moves up, you can infer that the Aroon Up line crosses above the Aroon down. When the oscillator moves up, you will know that the price is at a new high.

Rather, you should wait for the price of the security to breakout of a range or trend line before opening a new position in the direction that the Aroon suggested. We are going to backtest our strategy by investing a hundred thousand USD into our trading strategy. So first, we are storing the amount of investment into the ‘investment_value’ variable. After that, we are calculating the number of Tesla stocks we can buy using the investment amount.

It is primarily used by those who use a trend-following strategy. Arrow indicators for binary options are the tools for “the lazy”. In the Forex charts they indicate with arrows the potential points of the market entering. Indicator description, settings, entry, and exit conditions. Oscillators define the overbought and oversold states of the market, the trend strength.

A score below 50 means that the high/low occurred within the previous 13 periods. Track the price highs and lows of the asset for the last 25 periods. As such, we should be careful in initiating any new positions as it can lead to a higher chance of false breakouts or continued directionless price action. The opposite is true when the Aroon down line crosses above the 50 threshold from below. This occurrence suggests that the markets are moving from a state of bullishness to a state of bearishness.

How to use Aroon Indicator for mastering market timing – Moneycontrol

How to use Aroon Indicator for mastering market timing.

Posted: Sat, 25 May 2019 07:00:00 GMT [source]

The Aroon Indicator is classified as an oscillator since the values fluctuate between calculated upper and lower boundaries. The indicator chart typically has two lines, an “Up” version and a “Down” version, which simultaneously measures the momentum in either direction. When polar opposites occur, overbought or oversold conditions are at play.

All three take a single parameter which is the number of time periods to use in the calculation. Since Aroon and Aroon both oscillate between 0 and +100, the Aroon Oscillator ranges from -100 to +100 with zero serving as the crossover line. We combined the Aroon trend strength strategy and Aroon pullback trading strategy into one big market edge. If you enjoyed this method, be sure to check out other proven in the Best Trading Strategies Article.

The indicator signals when this is happening, and when it isn’t. The Aroon Indicator is an effective tool used in the technical analysis of an asset’s price. The indicator signals when there is a strong uptrend or downtrend. It is particularly effective when used alongside other indicators and can help traders identify trends and develop strategies based on them. For example a 14 Day Aroon-Up will take the number of days since price last recorded a 14 day high and then calculate a number between 0 and 100. A 14 Day Aroon-Down will do the same thing except is will calculate a number based of the number of days since a 14 day low.

Aroon will be equal to zero, if the trading instrument is recording a new peak during the examined time period. Aroon will be equal to +100, if the instrument marks a lower close than it has during the remainder of the time period. The Moving Average Convergence Divergence is both a momentum and trend following indicator.It is calculated by… When it is more than 50, a low was seen within the 12.5 periods. A down reading close to 100 signifies a low was recently seen.

The trend reversal signals the Aroon Up and Down indicator can often result in a significant trend reversal. However, these signals should be in confluence with other trend reversal setups in order to be more accurate. This version of the Aroon Up and Down indicator however is preset at 14 periods rather than the standard 25. This creates a more responsive trend following indicator.

Aroon Indicator on a chartThe indicator is composed of the Aroon Up line, which detects the overall strength in an uptrend. On the other hand, the Aroon Down line traces the strength of the downward trend. To properly use and take advantage of the Aroon Indicator, you need to know how the AroonUp and AroonDown lines work and how they are used in the market. Upon interacting with the tool, you’ll notice that the default time for the indicator is usually 25 days.

Saved lines will appear on all Charts for the symbol provided that the chart is shown with the same Period setting. To adjust the settings of an existing Plot just click on the Plot to display the details popup. For example, to change a Plot containing EMA to EMA, first click on EMA, change the Period to 100, and click an ‘Apply…’ button to save. You can create unlimited combinations of Symbols and Chart settings for easy retrieval across all of your devices and locations. All information on The Forex Geek website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income, expressed or implied, do not represent a guarantee.